Branded Risk Classifications

| Tip: You can cover the material below in about 15 minutes. |

Here's a potential type of exam question related to Branded Risk Classifications:

Question: Calculate the IRIS ratio, determine whether it's within the acceptable range for that ratio, and identify the risks associated with that ratio.

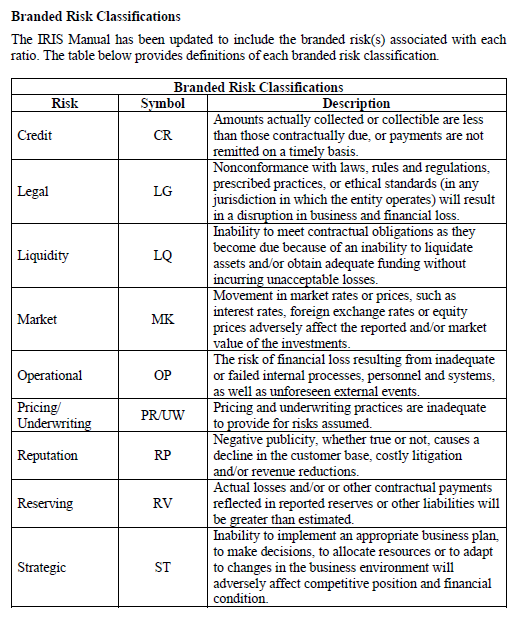

It's the last part of the question on risk identification that's related to the topic of Branded Risk Classifications. Below is the table provided in the source text:

If you look at the "Risk" column, you'll see they listed the risks in alphabetical order, which I thought was helpful. My memory trick is to take the first letter of each but split the list of 9 items into 3 groups:

- CLL – MOP – RRS

Because of the double letters LL and RR, and the fact that the middle 3 letters spells a word, I can memorize that pretty easily. Then you just have to remember what the letters stand for, but the different kinds of risks should all be familiar to you so this list shouldn't be too hard to remember.

Actually, aehayes47 came up with a better mnemonic:

- MOPS CL²R² ← shout-out to aehayes47!

"It sounds like Mops clear and kind of goes together nicely!"

I would read over the definitions but I don't think you need to specifically memorize them because most of them are pretty obvious based on general knowledge. If you're asked for the definition of any of these terms on the exam, you could probably come up with an acceptable answer even if it isn't word-for-word what's given in the table. You should spend a few minutes to see if you can do that and if there are any for which you can't give a reasonable answer, then go ahead and memorize those.

The second part of what you may need to know from this section on Branded Risk Classifications is which risks are associated with each IRIS ratio. You could probably figure out most of them based on general knowledge but here's a summary table:

Ratio # Description Branded Risks 1 GROSS PREMIUMS WRITTEN TO POLICYHOLDERS’ SURPLUS PR/UW, ST 2 NET PREMIUMS WRITTEN TO POLICYHOLDERS’ SURPLUS PR/UW, ST 3 CHANGE IN NET PREMIUMS WRITTEN PR/UW, ST 4 SURPLUS AID TO POLICYHOLDERS’ SURPLUS PR/UW, ST 5 TWO-YEAR OVERALL OPERATING RATIO OP 6 INVESTMENT YIELD LQ, MK, ST 7 GROSS CHANGE IN POLICYHOLDERS’ SURPLUS OP, ST 8 CHANGE IN ADJUSTED POLICYHOLDERS’ SURPLUS OP, ST 9 ADJUSTED LIABILITIES TO LIQUID ASSETS LQ 10 GROSS AGENTS’ BALANCES (IN COLLECTION) TO POLICYHOLDERS’SURPLUS CR 11 ONE-YEAR RESERVE DEVELOPMENT TO POLICYHOLDERS’ SURPLUS RV 12 TWO-YEAR RESERVE DEVELOPMENT TO POLICYHOLDERS’SURPLUS RV 13 EST. CURR. RESERVE DEFICIENCY TO POLICYHOLDERS’ SURPLUS RV

So that's all there is on this topic. I think you can cover it in around 15 minutes.