Spring 2017 #11 a

In the TIA formula we use mean surplus over 2 years in the calculation, but in the problem we are only given enough information to calculate one year. How should we know that we only include one year of surplus here? I was stuck on trying to figure out how to calculate it for 2014 as well.

Comments

In the problem, Homeowners surplus is allocated from the mean of all-lines surplus for the years 2014 and 2015. So, the HO surplus is also the mean of two years. I don't see why you think it's calculated for one year.

If you compare spring 2017 #11 and Fall 2015 #13, they both involve allocating surplus but one is shown as the mean surplus and the other is the surplus for a specific CY, but from what I can tell, the same calculations are used. I think my confusion is coming from sometimes you need mean surplus and sometimes you need surplus for a specific CY but the calculations don't change (from what I can tell).

2017.S.11 also calculates the investment gain for a single year, 2015, while using the mean surplus of two years, 2014 and 2015. The mean of two consecutive years' surplus is taken as the basis to calc investment gain, because surplus is continuously invested in the course of the year, and this approach approximates the amount of surplus invested during that time.

Minor error on the Excel version of Spring 2017, Q11 - typo in 'Ceded Reinsurance Premium Payable'

Corrected, thx!

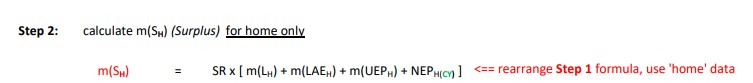

I had the same confusion as Owarnock. Given the surplus is actually a mean over the two years, shouldn't the formula really be m(S) = SR*[m(L)+m(LAE) +m(UEP)+NEPcy]?

I may be wrong, but the way it's written in the Wiki page read to me as surplus for CY for LoB A, not the average surplus over two years for LoB A.

The "S_A" notation used in the formula is less than ideal. But the "m(S)" notation is recaptured in the TIA formula, indicating that it is understood that the average surplus is used for TIA_A. From there, you apply the NIGR on TIA_A to get the NIG_A.

Sorry but i am also having the same confusion as Owarnock. For both questions, the following formula is used.

Formula: SA = SR x [ m(LA) + m(LAEA) + m(UEPA) + NEPA(CY) ]

However, 2017.S.11 is using the formula to have mean surplus of 2014 and 2015

but 2015.F.13 is using the formula to calculate allocated surplus shown in 2014 IEE (i perceive that means surplus for 2014 only but not a mean of 2013 and 2014).

While surplus ratio is calculated using the mean surplus, it makes more sense to me that the S_a is also a mean surplus. However, in that case it is not the answer for 2015.F.13.

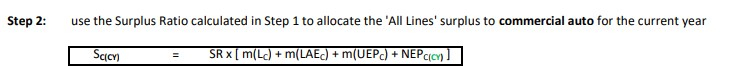

Sorry, I don't see the SA formula. I see this in the Alice solution to 2017.S.11:

I think Graham revised the notation since we had the dialogue above.

I tried to screen cap the formula shown in Alice solution to both 2015.F.13 and 2017.S.11 respectively. The formula are the same but 1 is to calculate Surplus for current year and 1 is to calculate mean surplus of 2 years.

S(CY) was meant to depict the same thing as m(S). It was meant to notate "of the IEE of CY, where the average of surplus as of end of two years is supplied." However, this does get confusing when you use CY for NEP as well, so we will discard this notation. Thanks for pointing it out.